Our Story

Born out of necessity. Built for supremacy.

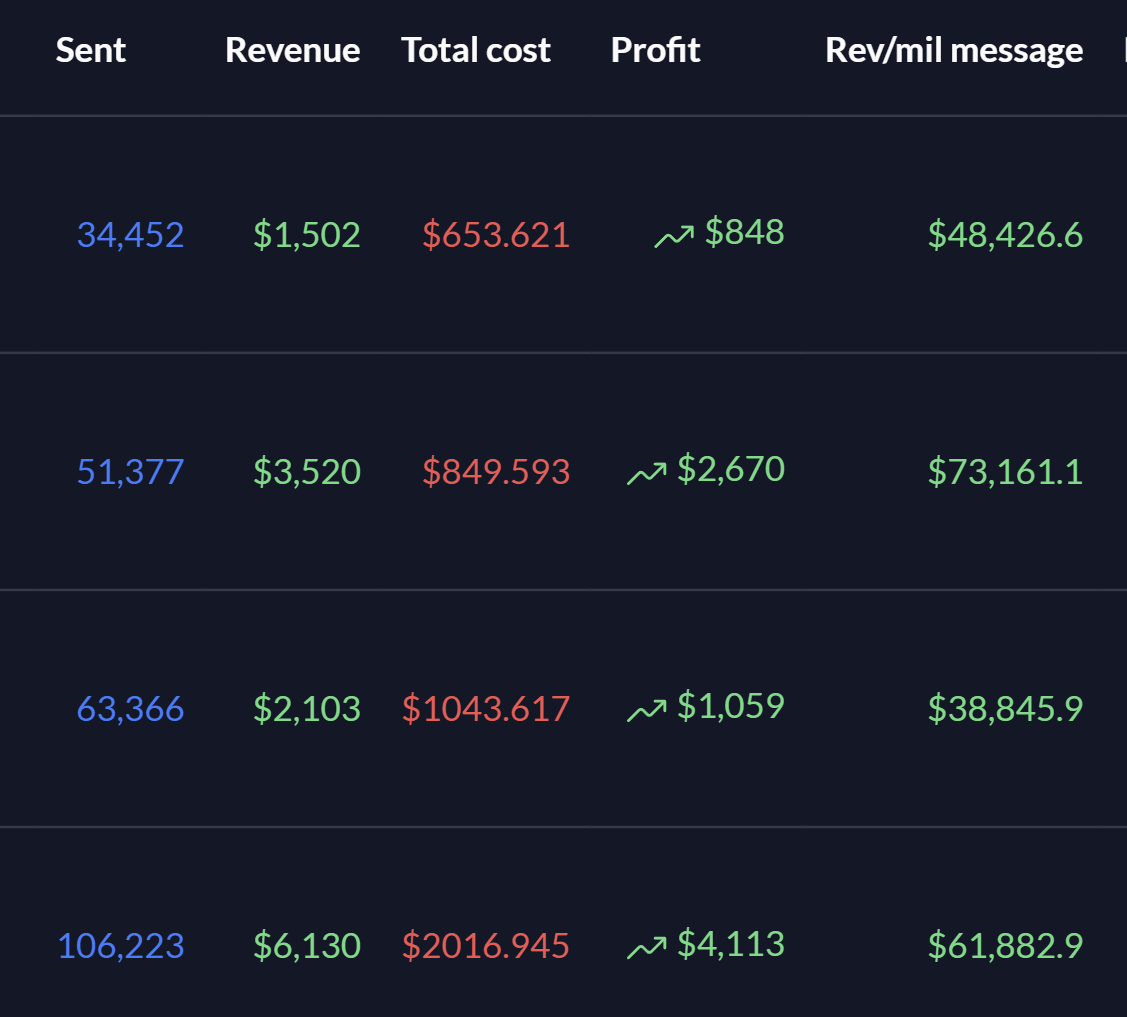

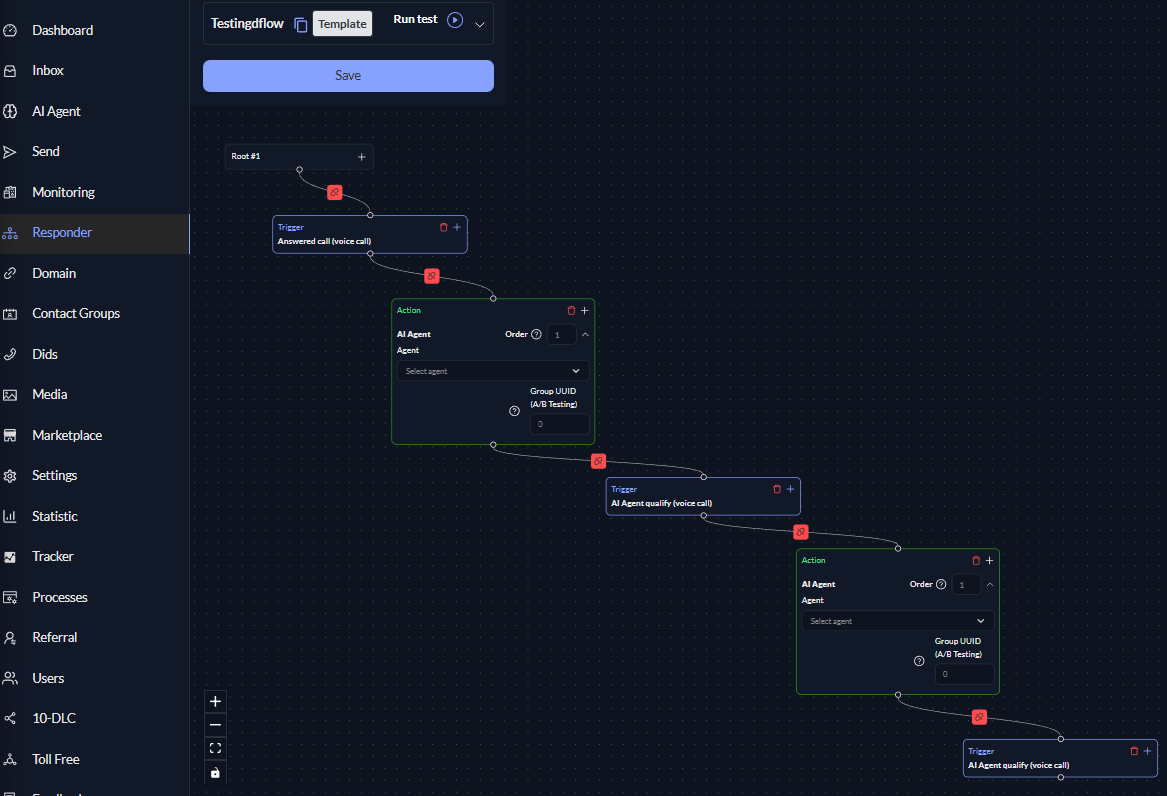

Textback.ai started inside one of the world’s largest SMS marketing agencies. We needed phone-first AI that could text, call, switch to SMS mid-conversation, and track every touch in one campaign, all the way back to the CRM. None of the tools could do it. So we built the stack ourselves.

Since 2018, Textback.ai has attracted peak AI and telecom talent to go beyond chatbots and dashboards: in-house models, carrier-grade infrastructure, and a proprietary data layer trained on billions of real interactions. The first commercial version shipped in 2019, and the platform has been compounding ever since.

Today, Textback.ai has delivered 10 billion AI SMS messages and scales AI voice to 10 million calls per day. Across insurance, iGaming, e-commerce, and more, we turn customer data into leads, conversions, and insight, with attribution that proves what works.

.png)

.png)

.png)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)